Aml Customer Risk Scoring Excel

The idea of money laundering is essential to be understood for those working within the monetary sector. It's a course of by which dirty cash is converted into clean money. The sources of the cash in actual are legal and the money is invested in a way that makes it seem like clear money and conceal the identification of the felony a part of the cash earned.

While executing the monetary transactions and establishing relationship with the new prospects or sustaining present prospects the obligation of adopting satisfactory measures lie on each one who is part of the group. The identification of such element in the beginning is easy to cope with as an alternative realizing and encountering such conditions afterward in the transaction stage. The central financial institution in any nation provides complete guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously provide sufficient safety to the banks to discourage such conditions.

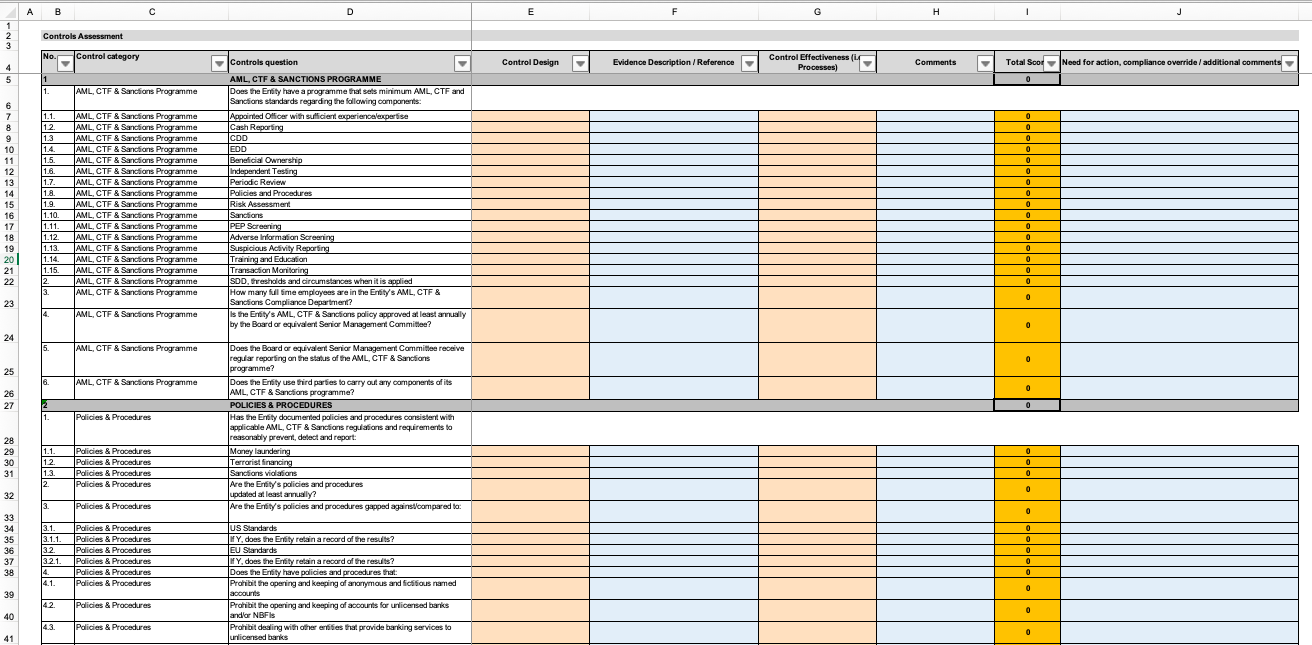

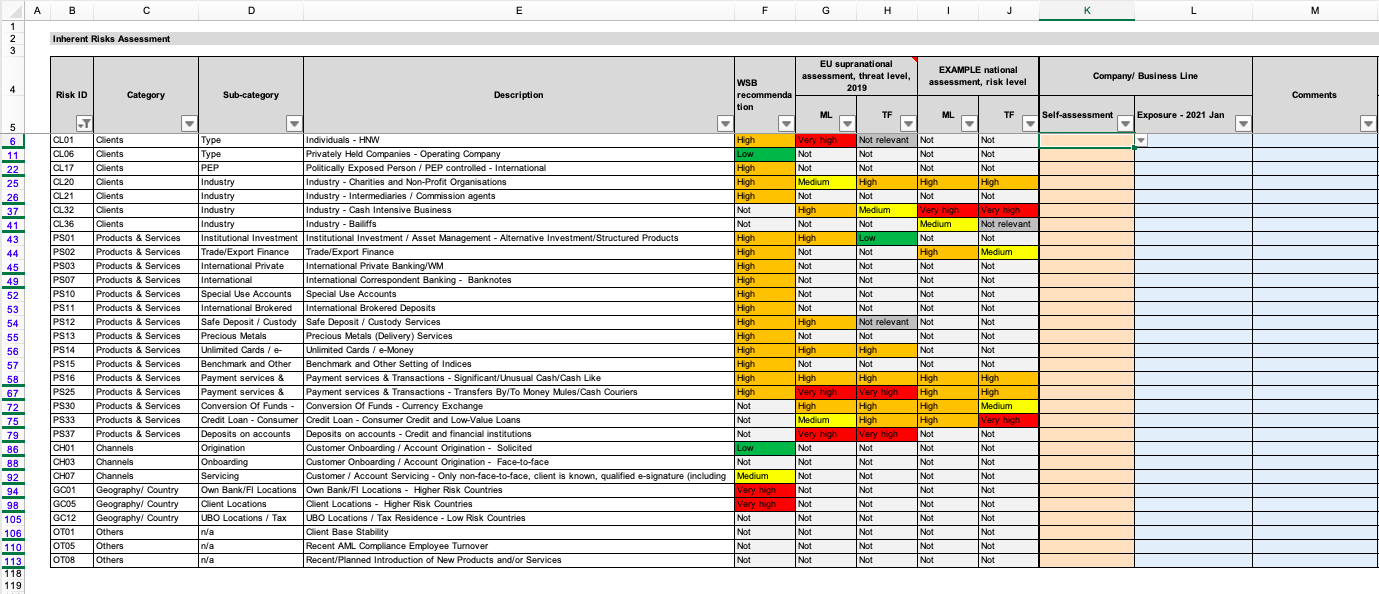

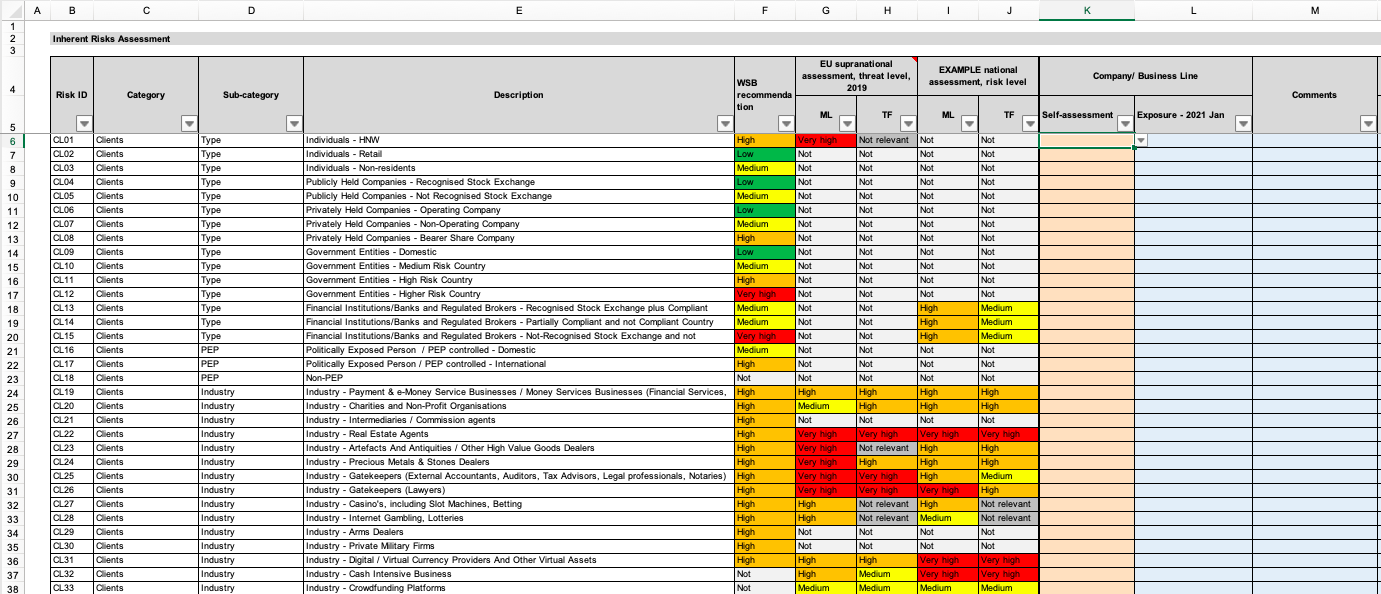

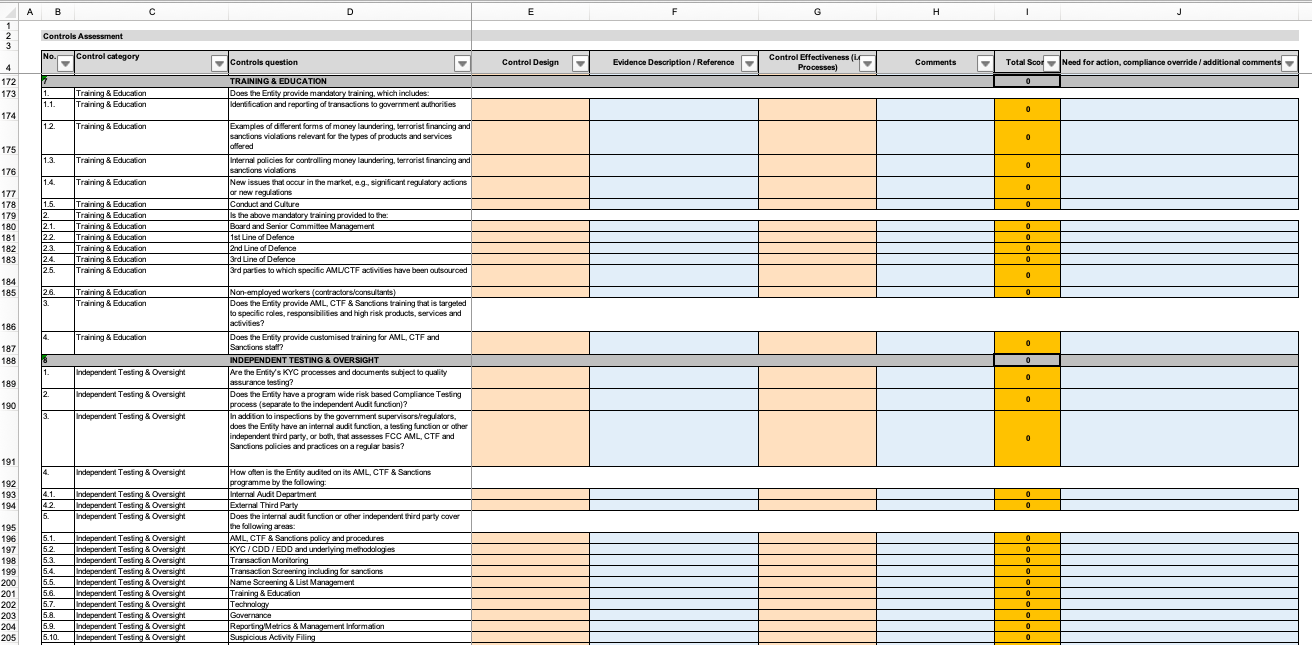

Automated Custom Risk Scoring Fully dynamic risk engine allowing you to define any aspect of risk both regulatory and internal risk appetite. Model is populated with the most common AML CTF Sanctions risks as well as controls.

Aml Risk Assessment Methodology

Identified higher risk transactions Eg.

Aml customer risk scoring excel. Examples of such low risk scenariosfactors may include. Anti-Money Laundering and Countering Financing of Terrorism Act 2009 the AMLCFT Act or the Act by assessing the risks of money laundering and terrorist financing MLTF to your business and by implementing a programme to manage those risks. New customers carrying out large one-off transactions Introduced customers because the introducer may not have carried out due diligence thoroughly Customers who arent local to you Customers involved in a.

Risks of MLTF vary from business to business as will the best ways to mitigate those risks. Employ technology-based screening for effective enhanced due diligence 3 Eg. The conclusion should include a short narrative in support of the conclusion.

AMLKYC reviews the threshold is normally 25 for low risk customers. High exposure to higher risk customers Eg. Additionally FATCA monitoring for change in circumstances is not riskbased must be monitored as it occurs and applies to all customers January 2015 the FDIC released a statement encouraging institutions to take a risk based approach in assessing all.

Introduce limit for identified higher. High exposure to politically exposed persons Eg. FIs typically use a high-risk country list for two primary purposes.

AML compliance programme aligns with its risk profile develop risk mitigation strategies including applicable internal controls and therefore lower a business unit or business lines residual risk exposure ensure senior management are made aware of the key risks control gaps and remediation efforts. Fore refence inherent risk scores template includes EU assessment of the risk of ML and TF affecting the internal market and relating to cross-border activities from 2019 as well as an example of national ML TF risk assessment with actual scores. Approval may be evidenced in writing or electronically.

Assess the Risk by using. Low risk factors for Customers A financial institution regulated supervised by the State Bank of. The re-review period is defined in the Risk Category table based on the ranges of the Customer Effective Risk CER score.

Customer risk scores are computed via machine-learning approaches utilizing transparency techniques to explain the scores and accelerate investigations. Generating a Customer Risk Rating. The below customer elements need to be risked assessed by entering into the risk rating tool to generate an overall customer risk rating of.

An exhaustive audit trail. AMLCFT measures include the maturity and sophistication of the regulatory and supervisory regime in the country. If the customer poses high risk to the bank or FI then the customer will be reviewed more often compared to medium or low risk customers.

What types of customers pose a risk. Or the level of financial exclusion. This should indicate why customers have been rated as high medium or low and also if any customer has been overridden manually to a higher or lower risk rating over the system generated risk score and rating.

Monitor higher risk customers transactions with greater sensitivity 2 Eg. This is particularly valuable for financial institutions since government regulators encourage organizations to conduct annual risk assessments to expose potential money laundering and terrorist financing activities. Institutions that have nonresidential aliens NRAs as customers can use the country of origin to assign a risk rating to the customer.

The risk model should be designed to generate a revised risk score and rating when such an event is triggered. The level of corruption and the impact of measures to combat corruption. The ever-present dependence on individual subjective assessments and inherent bias is totally eliminated from the on-boarding process thanks to KYC Portals risk assessment module.

These risk assessment templatesmatrices have detailed risk scoring logic and formulas that calculate the overall risk score. 255 rows Risk assessment templates used by financial institution firms are either in Excel in a third-party platform or built into and managed within an internal tool. And customer data are updated continuously while external data such as property records are used to flag potential data-quality issues and prioritize remediation.

Quantitative and qualitative criteria customisable risk factors such as customer risk country risk productservice risk industry risk and delivery channel risk. Customer and the beneficial ownership is publicly available. The first purpose is to assign customers with a risk score as part of the institutions due diligence processes.

Based on the various considerations above which are intended to prompt considerations of areas that may be considered to be of a higher risk from a money laundering perspective each firm is required to conclude on an overall money laundering risk assessment for the firm. The solution incorporated the ability to periodically conduct customer data analyses to keep compliance management personnel informed of new risks to the bank. Risk assessment and scoring tool to assess the AML Risk for your clients based on the customers profile risk factors and weighted parameters.

Such factors may affect the MLFT risks and increase or reduce the effectiveness of AMLCFT measures. Low Medium or High The firm may also use a risk category of Low or High without the Medium rating When the risk rating tool generates a final rating the AML Compliance Officer will be sent a notification for approval. Based on the customers risk score the KYC system determines the next review date.

In such circumstances and provided there has been an adequate analysis of the risk by the banksDFI SDD measures may be applied.

Enterprise Wide Aml Ctf Sanctions Risk Assessment Ewra Template Eloquens

Annex 6 Examples Of Risk Assessment Tools Fatf Guidance Anti Money Laundering And Terrorist Financing Measures And Financial Inclusion With A Supplement On Customer Due Diligence Updated November 2017 Better Regulation

Aml Risk Assessment Template Xls

Risk Analysis Matrix Examples Table 2 Nhs Qis Core Risk Assessment Matrix Consequence Descriptors Risk Management Risk Matrix Risk Analysis

Aml Kyc Risk Rating Assessment Template Methodology Rating Matrix Download Template Advisoryhq

Enterprise Wide Aml Ctf Sanctions Risk Assessment Ewra Template Eloquens

Enterprise Wide Aml Ctf Sanctions Risk Assessment Ewra Template Eloquens

Manufacturing Process Audit Checklist Template Pdf Sample In 2021 Internal Audit Checklist Template Report Template

Explore Our Sample Of Anti Money Laundering Policy Template For Free Policy Template Money Laundering Policies

Enterprise Wide Aml Ctf Sanctions Risk Assessment Ewra Template Eloquens

Anti Money Laundering Aml Ranks As One Of The Top Priorities Of Banks Worldwide Regulatory Age Money Laundering Evaluation Employee Employee Evaluation Form

Enterprise Wide Aml Ctf Sanctions Risk Assessment Ewra Template Eloquens

Aml Kyc Risk Rating Assessment Template Methodology Rating Matrix Download Template Advisoryhq

The world of regulations can appear to be a bowl of alphabet soup at times. US cash laundering regulations are no exception. We've got compiled a list of the highest ten money laundering acronyms and their definitions. TMP Threat is consulting firm targeted on protecting monetary companies by decreasing danger, fraud and losses. We have now big financial institution expertise in operational and regulatory danger. Now we have a powerful background in program administration, regulatory and operational danger in addition to Lean Six Sigma and Business Process Outsourcing.

Thus money laundering brings many adversarial penalties to the group as a result of dangers it presents. It increases the chance of major risks and the opportunity cost of the financial institution and in the end causes the financial institution to face losses.

Comments

Post a Comment